Judge’s absence, poor show fail to stymie Yankees’ financial growth, reveals Fitch

Sara Molnick

More Stories By Sara Molnick

- Mother’s Day: How Anthony Volpe’s mom molded him into a Yankee phenom

- Insider predicts return of Gleyber Torres to Yankees for 2025

- Kay reveals why Yankees fans ‘dead wrong’ about Juan Soto, expert puts him above Judge

- Luke Weaver hails Yankees, calls for early extension talks this winter

- Why Caleb Durbin is the Yankees’ most crucial prospect to protect in the Rule 5 draft

Table of Contents

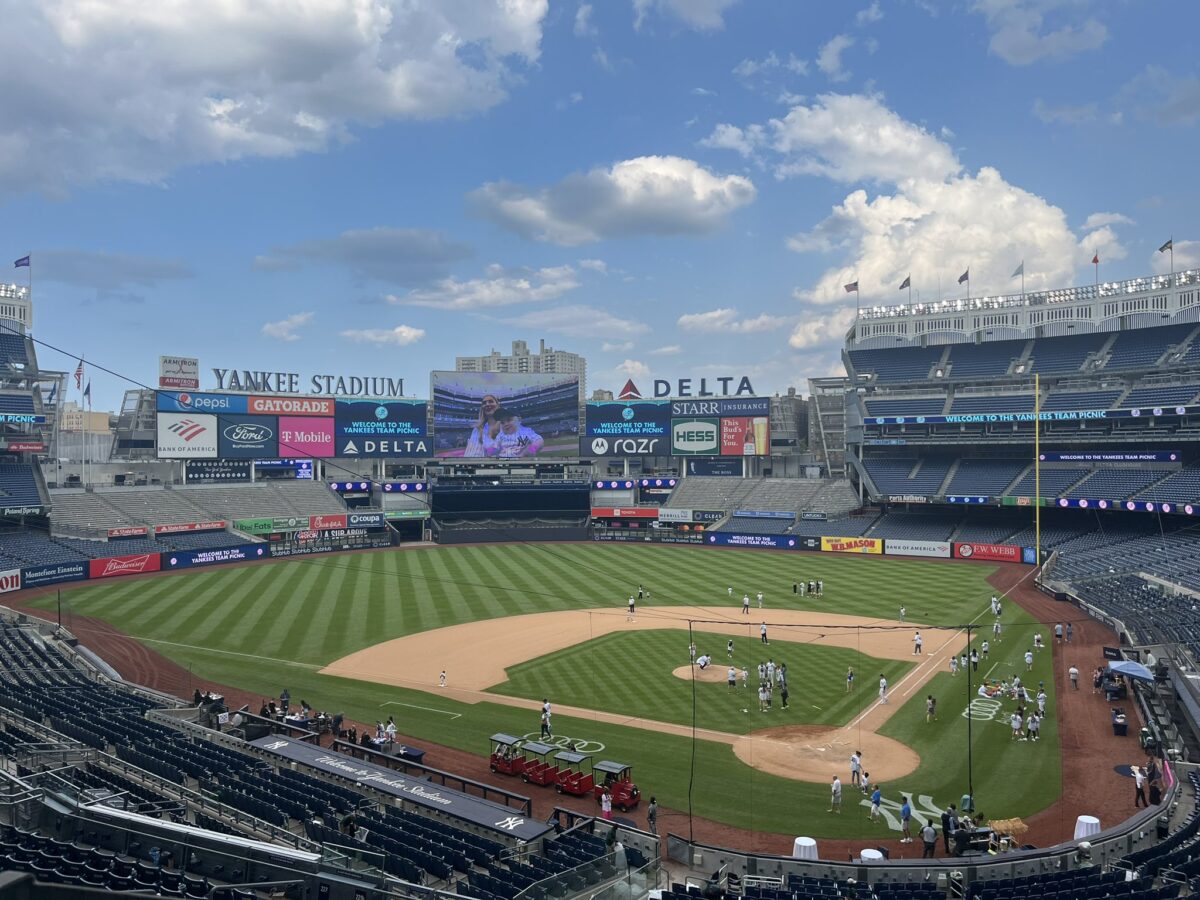

The New York Yankees remain the most valuable baseball franchise and their home, Yankee Stadium, too commands a greater financial outlook than ever. The latest Fitch ratings confirm that the Yankees’ projected revenue remains robust despite they are deprived of crowd-puller Aaron Judge for a significant part of the season and struggling at the bottom of the AL East.

In its latest assessment, Fitch Ratings reaffirmed the BBB+ rating on the New York City Industrial Development Agency’s PILOT revenue bonds (series 2006, 2009, and 2020) and the NYCIDA’s rental revenue bonds (series 2006 and 2009), which were issued for the Yankee Stadium Project on behalf of Yankee Stadium LLC (StadCo). These bonds were utilized to fund the construction of the stadium that commenced operations in 2009. Fitch further indicated that the rating outlook remains stable.

The Yankees are the richest MLB team

The New York Yankees stand as the most valuable team in baseball, with an estimated worth of $7.1 billion. During the year 2022, the team achieved a staggering $657 million in revenue, after accounting for revenue sharing and PILOT payments, making it the highest revenue-generating team in Major League Baseball.

The Fitch report underscores the team’s brand value and consistent support from loyal fans, along with stadium revenue, as significant factors in the Yankees‘ financial strength. It highlights the team’s position as a premier franchise in Major League Baseball (MLB) and the enduring demand for premium seating fueled by the vibrant New York City economy. The report also emphasizes the team’s resilient fan base, which has demonstrated unwavering support even during economic downturns in the past.

Moreover, the report mentions that the strong commitment to allocated proceeds ensures robust coverage for StadCo’s operational expenses, stadium PILOT, and lease obligations. The average debt service coverage ratio (DSCR) at the StadCo level, considering PILOT and rental payments as debt obligations, is projected at 2.6x from 2023 to 2040.

Certainly, the Yankees have recently secured the most lucrative jersey patch deal in baseball. Their agreement with Starr Insurance is set to yield nearly $190 million over the span of the contract, covering the period until 2030. This deal will result in an annual average of $25 million in revenue for the team until the year 2030.

Yankees garner a big share from ticket sales

The rating agency’s projections for revenue generated by the Yankees’ ballpark, particularly from tickets and premium seating, offer valuable insights. In 2023, the performance has been notably higher than in 2022, mainly driven by robust demand for premium seating and suites at the stadium, as well as unwavering support from dedicated Yankees fans. Fitch specifically highlights that demand for non-premium seating remains strong, with a notable increase in full-season ticket sales compared to the previous year. As a result, regular season-assigned proceeds for 2023 are expected to surpass the levels of the prior year.

According to the report: “Fitch’s base case assumes that the strong year-to-date trends observed in the 2023 season will result in total assigned proceeds of $341 million, down slightly from 2022 levels. Fitch’s base case assumes that assigned proceeds decline to $301 million in 2024, reflecting a modest drop in general admission and premium seating, and playoff assigned proceeds of $20 million.”

However, the Yankees have outperformed their cross-city rivals, the New York Mets, who had high expectations to contend for the World Series this season but have struggled with a 49-54 record, making their chances of making the playoffs slim. The Mets play their home games at Citi Field, which, like Yankee Stadium, was also inaugurated in 2009.

Fitch rates the Yankee Stadium bonds as a more secure investment compared to those of Citi Field. Both transactions share similar structures, involving PILOT and lease-backed debt with a pledge of tickets. However, Yankee Stadium receives a rating one notch higher than QBC (Citi Field). This distinction reflects the Yankees’ stronger franchise presence and the stadium’s consistently stable and robust levels of attendance and ticket revenues. While Citi Field has a broader range of available revenues, including sponsorships, parking, and concessions, the overall performance of Yankee Stadium makes it a safer choice for investors.

What do you think? Leave your comment below.

- Categories: New York Yankees, Yankees worth

- Tags: New York Yankees, Yankees worth

Follow Us

Follow Us

Boycott the skankees. It is the only way to force the Steingrabbers to make changes. Don’t buy tickets. Don’t buy merchandise. Don’t subscribe to Yes. Don’t throw your stuff away. Keep it for when the skankees get better.

I agree 100%. Until Yankees fans let Steinbrenner know we’re not going to accept his “business as usual” style of mediocrity, he’ll continue to give us crappy teams year after year. He’s so afraid of going over the final tier of the “luxury tax” we’ll never get out from under Cashman’s horrendous “deals” to sign old, washed-up players to multi-year contracts. Yet Steinbrenner rewards that cement-head with a four year extension on his contract.

The management of this team – from top to bottom – is completely out of touch with reality. Time to hit them where it hurts them the most: in their bank accounts. That seems to be the ONLY way to get their attention.