Tech Titans: How Microsoft, Amazon, and Starbucks made Alex Rodriguez regret his ’90s investment pass

Esteban Quiñones

More Stories By Esteban Quiñones

- Mother’s Day: How Anthony Volpe’s mom molded him into a Yankee phenom

- Anthony Rizzo’s game-changing blunder turns tide in Yankees’ loss to Angels

- LeMahieu embraces Yankees’ ninth hole, ready to ‘lurk down there’

- Yankees 3-4 Angels: Discredit goes to Rizzo, Holmes

- Yankees’ Jon Berti admits possibility of 2-month absence for calf strain

- October 28, 2023

- 4:35 pm

- No Comments

Table of Contents

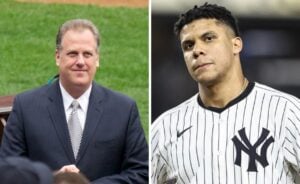

Alex Rodriguez, the former player of the New York Yankees, is no stranger to financial success, but even he has a few regrets when looking back on his career. One of his major regrets revolves around missed investment opportunities during the 1990s dot-com boom. In a recent interview with CNBC Make It, Rodriguez expressed his remorse for not delving deeper into the stock market during his early days as a baseball player in Seattle.

Reflecting on his time in Seattle, where he started his baseball journey in 1993, Rodriguez ruefully remarked, “When I was in Seattle, I wish I would have just bought a bunch of the locals. If I bought Amazon, Microsoft, and Starbucks, I wouldn’t have to work so hard today.”

This candid admission reveals the hindsight wisdom that can often torment individuals when they realize they missed out on lucrative investment opportunities.

Alex Rodriguez: From Baseball Star to Business Mogul

It’s worth noting that Alex Rodriguez, even without these missed investment opportunities, is far from financially strapped. He accumulated an astounding $455 million in salary, bonuses, and incentives throughout his impressive 22-year baseball career, as recorded in the sports contract database Spotrac. Forbes also estimates that he earned an additional $35 million through endorsements during this time. Given his substantial earnings, it’s evident that Rodriguez is far from struggling in the financial department.

In the present day, Alex Rodriguez has transitioned from a career in professional sports to a multifaceted entrepreneur. He serves as the CEO and chairman of A-Rod Corp, a startup investing firm he founded in 2003 while he was still actively playing baseball. Additionally, he occasionally appears as a guest judge on ABC’s “Shark Tank.” His current endeavors attest to his business acumen and financial prowess.

How Alex Rodriguez’s Early Investment Choices Could Have Made Him Millions?

Nonetheless, Rodriguez can’t help but wonder what could have been if he had invested in those iconic Seattle-based companies during the early days of his career. Let’s take a closer look at how those investments would have fared over the years.

In August 1993, when Rodriguez signed a three-year, $1.3 million contract with the Seattle Mariners, Microsoft’s stock price was a modest $2.35 per share. Fast forward to today, and Microsoft’s shares are valued at a staggering $334.21 apiece, marking a more than 142-fold increase in value over 30 years.

Similarly, Starbucks, which had its initial public offering (IPO) in 1992, was trading at just 74 cents per share when Rodriguez inked his first contract. Today, Starbucks shares command an impressive $93.08 per share, surpassing their original price by over 125 times.

While Rodriguez didn’t specify the hypothetical amount he would have invested, let’s consider a conservative scenario in which he put $1,000 into each of these stocks. With these investments, he would have seen returns of approximately $142,000 for Microsoft and $125,000 for Starbucks today. Had he opted for a more substantial investment of $10,000 in each, these figures would have skyrocketed to over $1 million for each stock.

Furthermore, Amazon, a company that went public in 1997, saw remarkable growth after Rodriguez had signed a four-year, $10.7 million contract extension. Although Amazon’s IPO price was $18 per share, subsequent stock splits adjusted that value to a mere 7.5 cents per share, according to the company’s website. Today, Amazon’s stock is valued at $129.65 per share, indicating an astonishing increase of more than 1,720 times the adjusted IPO price.

In the event that Rodriguez had invested just $1,000 in Amazon at the time of its IPO, that investment would be worth more than $1.7 million today. These hypothetical figures underscore the incredible growth potential of well-chosen stocks over the long term.

For Rodriguez, the lesson learned from these missed opportunities is clear: making smart long-term investments as early as possible is a key to financial success. As he advised in a 2019 interview, “You have an incredible opportunity if you’re frugal and you’re smart and you put your money away early. The ability to have compound interest over 20, 30, 40 years can make you a very wealthy young person in a short period of time.”

In many ways, Rodriguez has practiced what he preaches. He began his investment journey at the age of 22, initially starting small with a duplex. Over the years, his investment firm has grown significantly, currently owning over 20,000 multi-family apartments, among other assets. Rodriguez’s financial journey has been marked by a commitment to steady, long-term growth, which has proven successful in various ventures beyond the baseball field.

In addition to his roles as an entrepreneur, Rodriguez has continued to stay involved in the world of sports. He serves as a baseball analyst for both FOX Sports and ESPN and is a co-owner of the National Basketball Association’s Minnesota Timberwolves. Additionally, he has partnered with OraPharma to raise awareness about gum health following a recent gum disease diagnosis.

Reflecting on his journey as an investor, Rodriguez acknowledges that it hasn’t been without its share of mistakes and lessons. However, his steadfast dedication to playing the long game and his continuous pursuit of improvement have been integral to his enduring success in the world of finance and entrepreneurship.

- Categories: alex rodriguez, New York Yankees

- Tags: alex rodriguez, New York Yankees

Related posts:

Follow Us

Follow Us